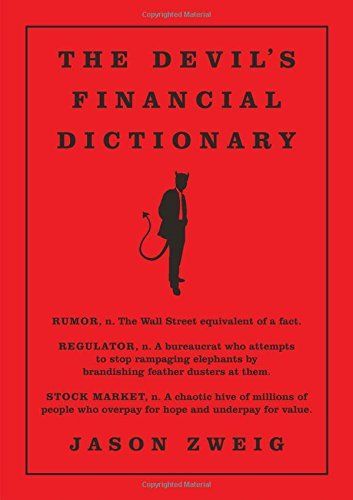

The Devil's Financial Dictionary

The Devil's Financial Dictionary is a witty and enlightening guide to the facts, fads, follies and fiction of business and investing. (See PRICELESS.) Definitions include: DAY-TRADER, n. See IDIOT. FEE, n. A tiny word with a teeny sound, which nevertheless is the single biggest determinant of success or failure for most investors. Those who keep fees as low as possible will, on average, earn the highest possible returns. MOMENTUM, adj. and n. A momentum stock” accelerates as it goes upward, defying the forces of friction, financial gravity, Newton's first law of motion, and logic and reason. There is no theoretical or empirical explanation of what causes momentum, why it persists (typically for two to 12 months), or why it ultimately falters. And when it ceases, a momentum stock doesn't slow down; it crashes at top speed into a brick wall, instantly crushing any trader who still happens to own it. All momentum traders fancy themselves to be able to predict exactly when the stock will lose its momentum -- and imagine that they will sell immediately before that. Approximately 99.999% of them are wrong. REGULATOR, n. A bureaucrat who attempts to stop rampaging elephants by brandishing feather-dusters at them. Also, a future employee of a bank, hedge fund, brokerage, investment-management firm, or financial lobby. (See REVOLVING DOOR.) RUMOR, n. The Wall Street equivalent of a fact. STOCK MARKET, n. A chaotic hive of millions of people who overpay for hope and underpay for value. The stock market serves not to allocate capital efficiently from those who have a surfeit of it to those who can put it to productive use in corporate enterprises; rather, it serves to humiliate those who think they know what the future holds. The stock market is a mechanism for putting a price tag on surprises. It transfers wealth from the arrogant to the humble, from those who trade the most to those who trade the least, from those who think they know the most to those who admit they know the least, and from those who pay commissions to those who collect them. Those who play” the stock market as if it were a game will lose. Those who respect it as a force of nature will prosper, but only so long as they are humble and patient.

Reviews

Dev Shah@notdevdutt

Pedro Giménez@pedro